The Kenya Revenue Authority (KRA) has published the first list of reportable jurisdictions under the Common Reporting Standard (CRS), a significant step in Kenya’s adoption of automatic exchange of financial account information for tax purposes.

The KRA’s publication of the list of CRS jurisdictions means that banking secrecy for Kenyans with money abroad is over.

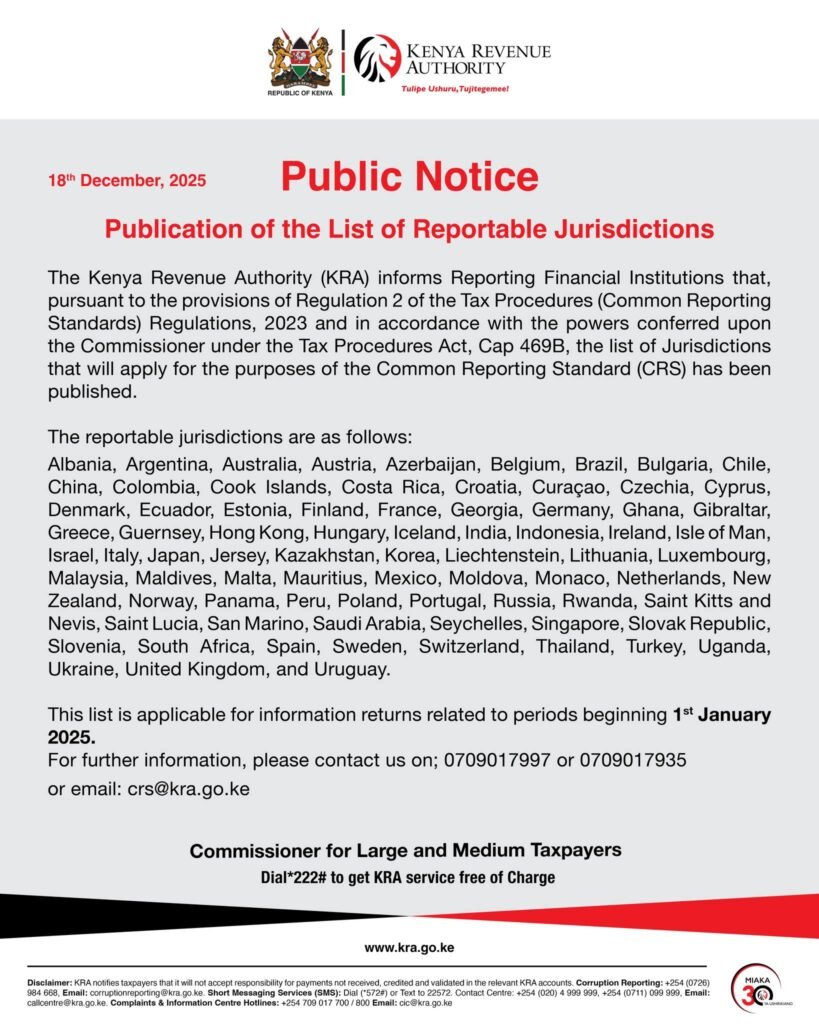

The announcement was made on December 19, 2025, through KRA’s official X account. According to the notice, “The Kenya Revenue Authority (KRA) informs Reporting Financial Institutions that… the list of Jurisdictions that will apply for the purposes of the Common Reporting Standard (CRS) has been published.”

The publication follows Regulation 2 of the Tax Procedures (Common Reporting Standards) Regulations, 2023, and the powers vested in KRA under the Tax Procedures Act, Cap 469B.

Cooperating Countries

The list comprises 62 jurisdictions, including major economies and regional partners such as Australia, China, Germany, India, South Africa, the United Kingdom, and Uganda, among others.

In essence, if you are a Kenyan tax resident with a bank account or other financial assets in any of the listed countries, your financial information will be automatically sent to the KRA every year.

KRA will now know exactly how much money you have in those foreign accounts, the balance at the end of the year, and any interest or dividends you earned.

The main aim of this global agreement is to stop people from hiding their income and assets in offshore accounts to avoid paying taxes in Kenya.

For those with legitimate foreign investments, this means ensuring their tax affairs and declarations to the KRA are fully accurate and up-to-date to avoid penalties.

“The jurisdictions include Albania, Argentina, Australia, Austria, Azerbaijan, Belgium, Brazil, Bulgaria, Chile, China, Colombia, the Cook Islands, Costa Rica, among others.”

Facts on CRS

The CRS framework was developed by the Organisation for Economic Co-operation and Development (OECD), and enables participating countries to automatically exchange financial account details annually to improve tax compliance. KRA indicated that the list will apply to information returns related to periods beginning January 1, 2025.

Reporting Financial Institutions, including banks and other entities holding financial accounts in Kenya, are required to conduct due diligence to identify accounts linked to tax residents of the listed jurisdictions and report the relevant information to KRA.

Financial institutions must update their compliance systems and internal procedures to meet the reporting obligations under the CRS framework, ensuring that Kenya aligns with international tax transparency standards.

In the announcement KRA provided contact information for inquiries, including telephone numbers 0709017997 or 0709017935, email crs@kra.go.ke, and the Commissioner for Large and Medium Taxpayers.

Additional services and guidance are available via *222# or on the official website, www.kra.go.ke.