President William Ruto has repeatedly highlighted diaspora remittances as proof of Kenya’s economic resilience, asserting that these inflows have increased substantially over the past three years and now surpass earnings from major exports such as tea, tourism, and coffee.

Central Bank of Kenya (CBK) data confirms that remittances have reached record levels in recent years.

How remittances have grown over time

According to CBK, annual diaspora remittances stood at about $1.57 billion in 2015. By 2019, inflows had doubled to roughly $2.87 billion, before dipping slightly during the Covid-19 shock in early 2020.

The recovery was swift. Remittances rose to $3.09 billion in 2020, then jumped sharply to $4.02 billion in 2021, representing a year-on-year increase of more than 30 per cent. This surge occurred before President Ruto assumed office in September 2022.

In 2022, remittances increased further to approximately $4.03 billion, an 8.3 per cent rise from 2021. By 2024, inflows had climbed to about $4.95 billion (around Sh638 billion), the highest level ever recorded, according to figures cited by the Presidency and CBK bulletins.

Performance during Ruto’s term

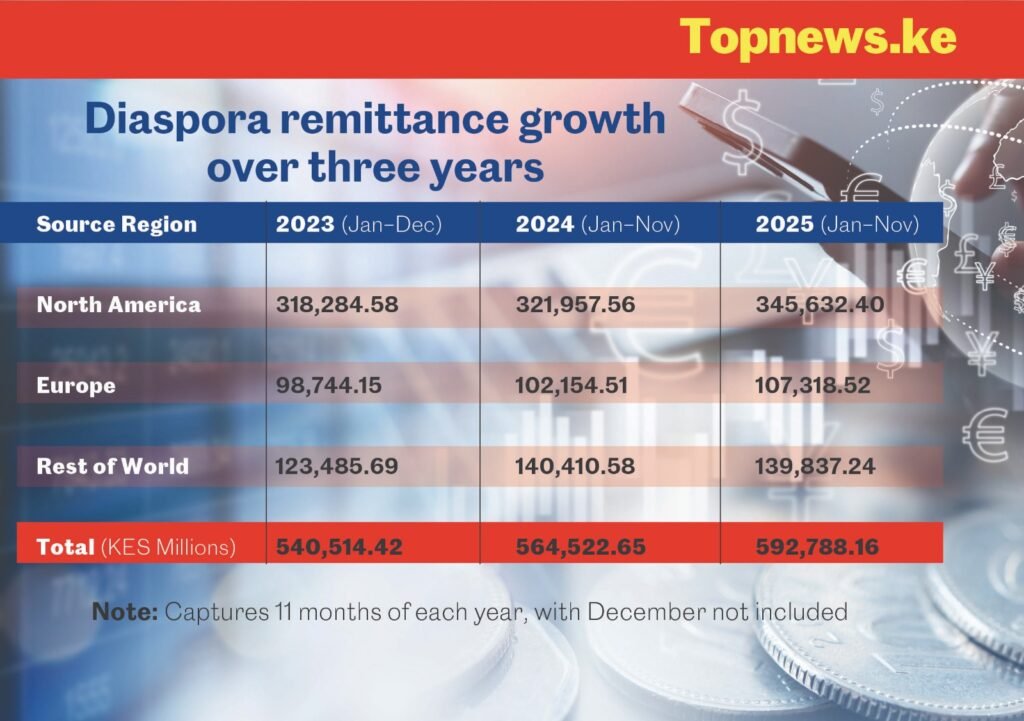

During Ruto’s first two full years in office, remittances grew by roughly $900 million to $1 billion. Monthly inflows averaged between $330 million and $440 million through 2023–2025, with December peaks driven by holiday-related transfers.

While this confirms continued growth, the pace has been more moderate compared to the post-pandemic rebound of 2020–2021, when remittances rose by nearly $1 billion in a single year.

Where the money comes from

The United States remains the dominant source, accounting for 55–58 per cent of all remittances to Kenya in most months. In March 2021, for example, the US contributed 55.9 per cent, a share that has remained broadly consistent.

Europe is the second-largest source, led by the UK, while the “Rest of the World” category, covering the Middle East, Canada and Australia, has grown steadily, supported by increased labour migration to Gulf countries.

This concentration means Kenya’s remittance growth is closely tied to economic conditions and employment stability in North America.

How remittances compare to exports

CBK data shows that since 2021, remittances have exceeded earnings from tea, coffee and horticulture individually, making them Kenya’s single largest source of foreign exchange. In 2022, remittances of $4.03 billion compared with total exports of about $5.77 billion, narrowing the gap significantly.

Remittances have also helped stabilise the shilling by supporting foreign exchange reserves, which stood at $6.3 billion (about 3.5 months of import cover) in early 2023.

Bottom line

President Ruto’s claim that diaspora remittances have grown in recent years is accurate.

Central Bank of kenya data shows sustained growth under his administration, yet the most dramatic acceleration began earlier, driven by global labour mobility, digital money transfers and post-pandemic recovery rather than new domestic policy shifts.